nevada vs california income taxes

Taxpayers in Nevada get to enjoy one of the most tax-friendly situations in the nation. This tool compares the tax brackets for single individuals in each state.

If Doctors Chose Their Job Locations Based On State Income Taxes White Coat Investor

Tax brackets for income earned in 2023.

. Incorporating in Nevada instead of California may provide you with tax savings and other corporate protection benefits. And Im talking about income taxes. This adds a significant toll to.

Interestingly the neighboring state of Nevada is ranked number one. Buts its common to pay about 5 of your income. With a top marginal income tax rate of 123 percent Nevada vs California taxes are known for having the highest state income tax bracket in the country.

100 US Average. Creating an LLC in California the state filing fee is 70 whereas in Nevada its 75. I think it is important to note the rates in the states as well.

In California the state income tax is 10 and. If you make 14001610 a year living in the region of California USA you will be taxed 7001610. The state of California ranks 40th in corporate tax rankings according to the Tax Foundation.

Above 100 means more expensive. This tool compares the tax brackets for single individuals in each state. Since the cost of living is much higher California has taxes on almost everything.

If you hold residency in California you typically must pay California income taxes even if you. Taxes on a 1000000 is approximately 6000. Local sales taxes increase this total with the largest total rates hitting 105.

California Income Tax Calculator 2021. Nevada on the other hand is known to tax less. Income tax rates vary a lot from state to state.

The state of California requires residents to pay personal income taxes but Nevada does not. Consumers in California are hit with a sales tax of 725. Taxes in Los Angeles California are 863 more expensive than Las Vegas Nevada.

In Nevada the state tax rate is 18 and the state sales tax is 9. 37 for incomes over 578125 693750 for married couples filing jointly 35 for incomes over 231250 462500 for. Use this tool to compare the state income taxes in California and Nevada or any other pair of states.

Below 100 means cheaper than the US average. Property Tax In Nevada vs. This rate however does.

When living in a state that has an average income. The most significant taxes you pay in Nevada. View a comparison chart of California vs.

Use this tool to compare the state income taxes in Nevada and California or any other pair of states. Also the list of common. For more information about the income tax in these states visit the.

The state of California requires residents to pay personal income taxes but Nevada does not. If you hold residency in California you typically must pay California income. The cost of Nevada vs California formation is almost the same.

Whether youre a doctor teacher real estate agent or entertainer. Your average tax rate is 3671 and your.

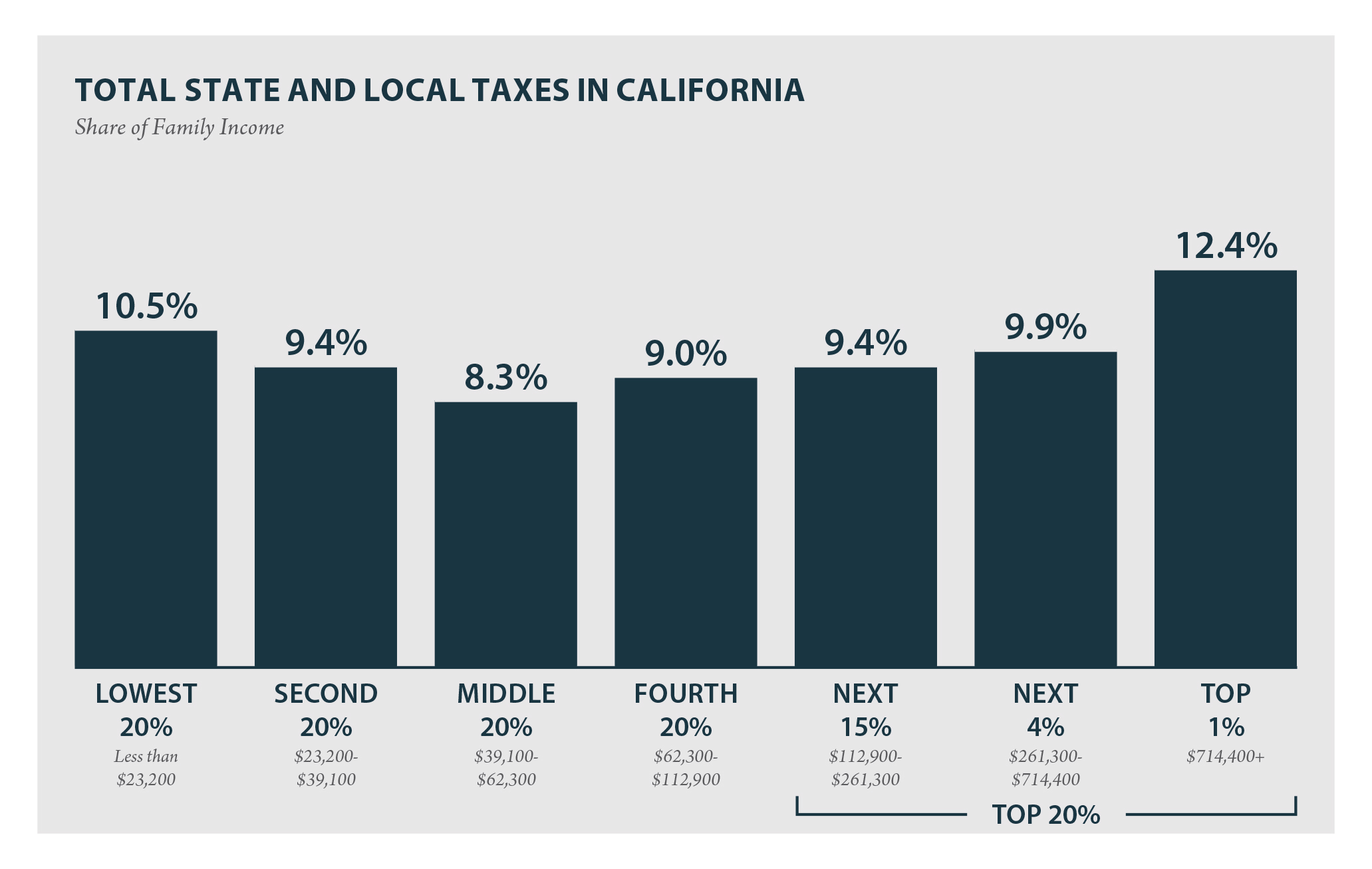

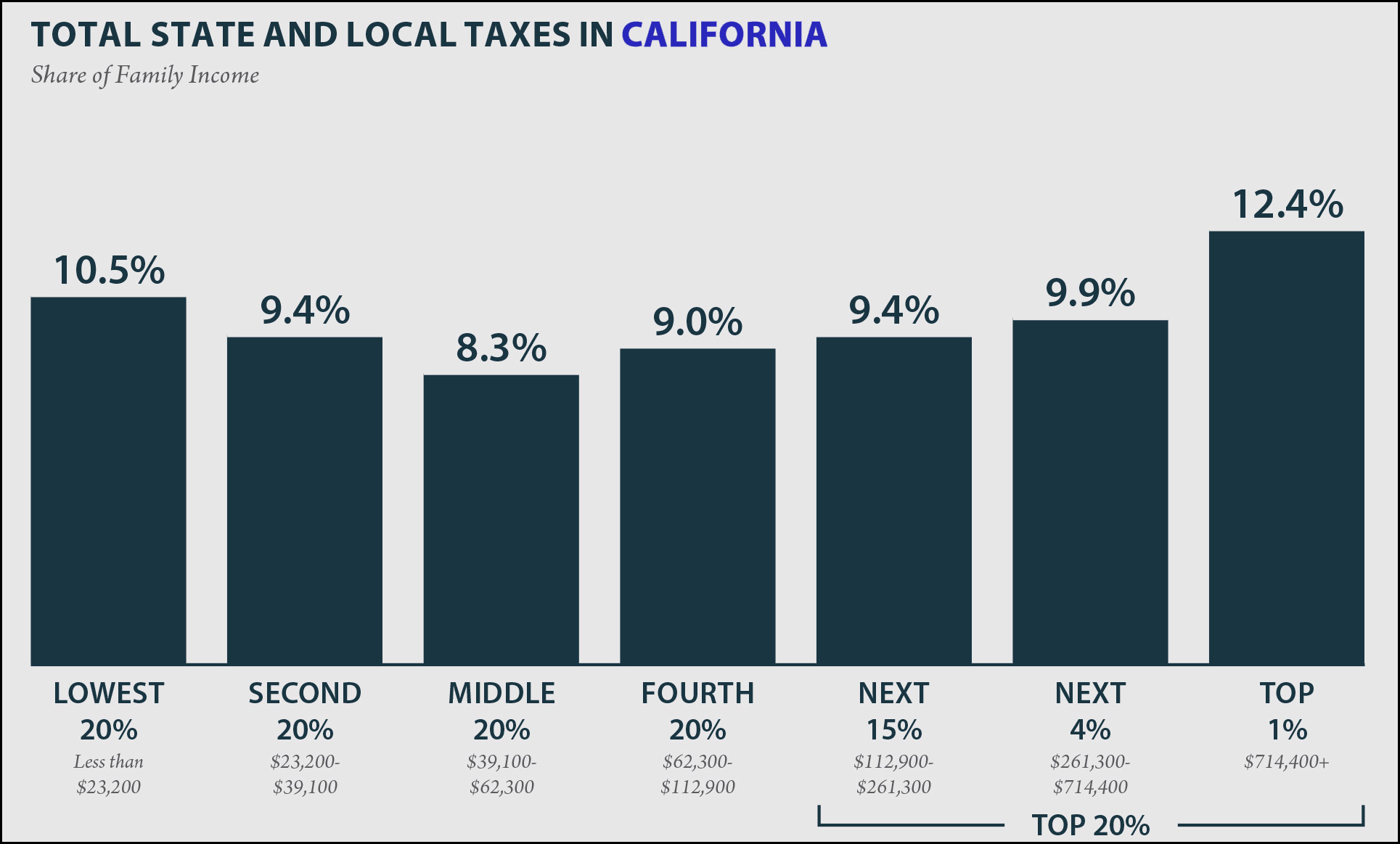

California Who Pays 6th Edition Itep

Retire In California Or Nevada Retirebetternow Com

2022 Federal State Payroll Tax Rates For Employers

Ohio Collected 34 9b In State Taxes In 2021 9th Highest In Country Cleveland Com

9 States With No Income Tax Bankrate

Tax Hike On California Millionaires Would Create 54 Tax Rate

We Don T Know If The Salt Cap Is Driving Away Residents Of High Tax States Tax Policy Center

The Property Tax Inheritance Exclusion

California Income Tax Calculator Smartasset

State Individual Income Tax Rates And Brackets Tax Foundation

Sales Taxes In The United States Wikipedia

General Sales Taxes And Gross Receipts Taxes Urban Institute

States With The Highest And Lowest Income Taxes Experian

Taxes Are Surprisingly Similar In Texas And California Mother Jones

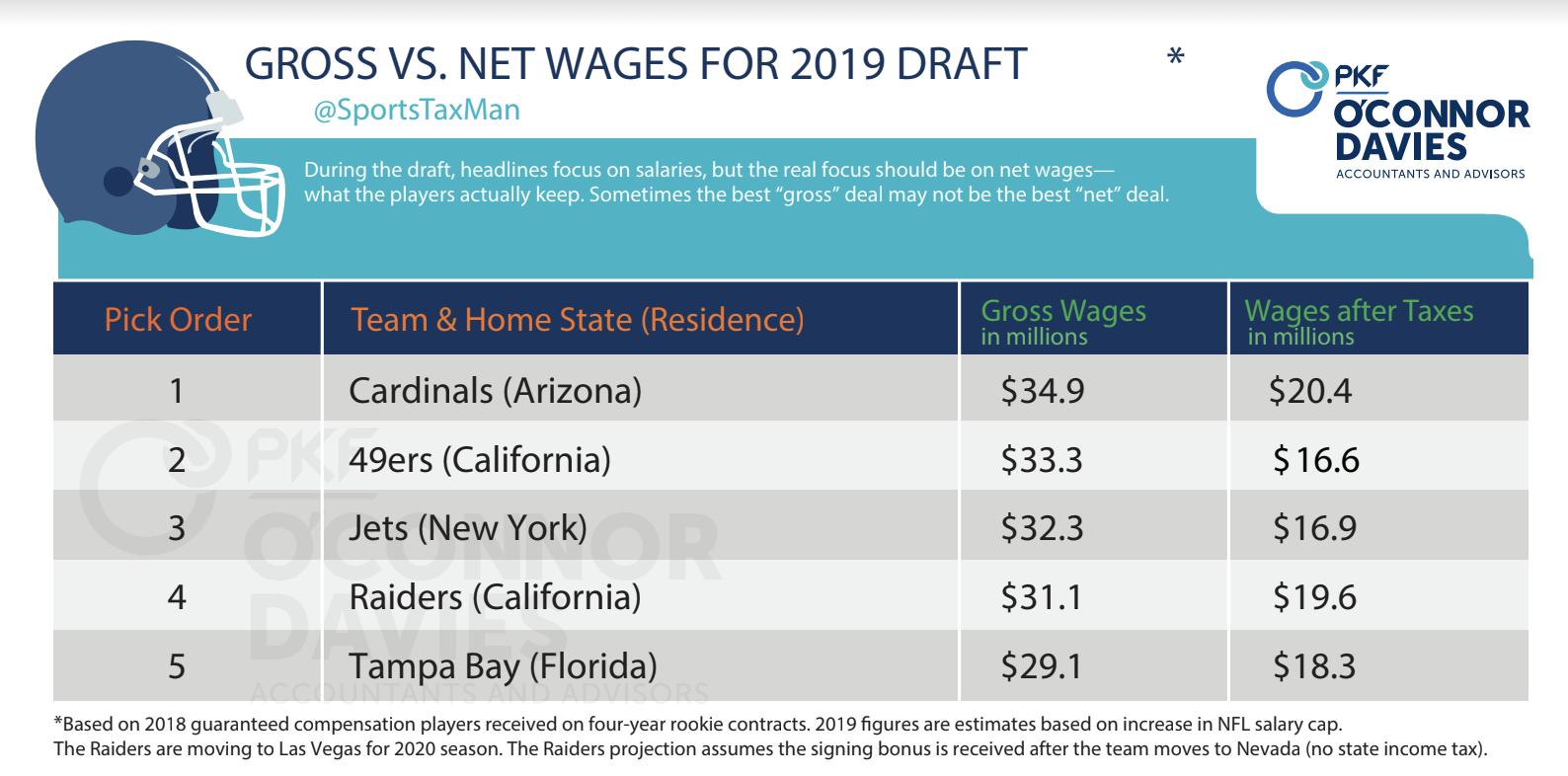

Michael Mccann On Twitter The Raiders Pending Move From California Highest State Income Tax In U S To Nevada No State Income Tax Could Alter How Agents For Players Drafted By The Raiders

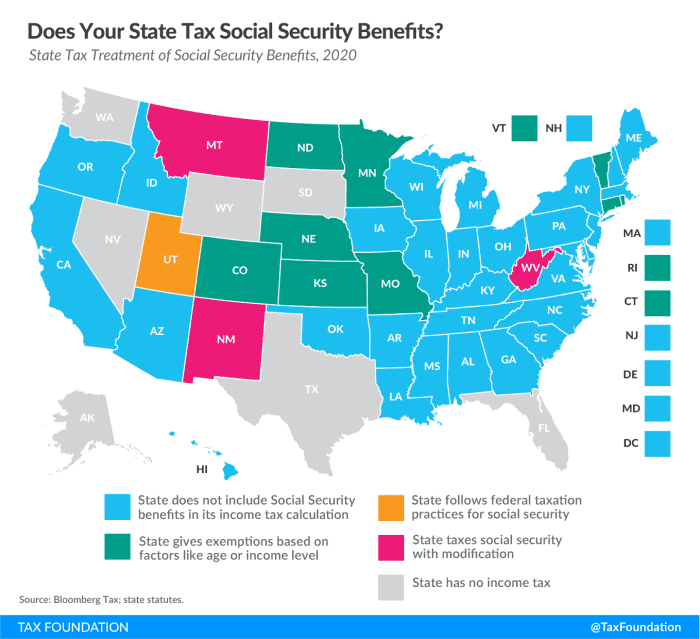

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

Top 10 Inbound Vs Top 10 Outbound Us States In 2021 How Do They Compare On A Variety Of Economic Tax Business Climate And Political Measures American Enterprise Institute Aei